Back

14 Jan 2020

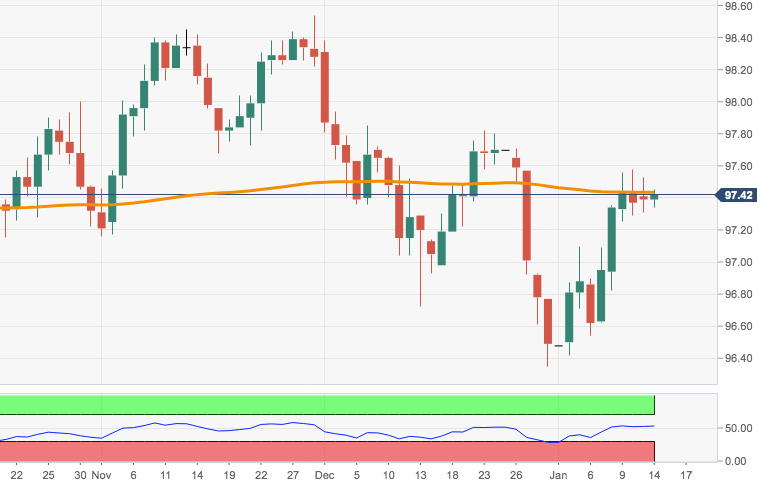

US Dollar Index Price Analysis: Upside still capped by 97.70

- The index keeps pushing higher in the 97.50 region.

- Extra gains are expected above the 200-day SMA near 97.70.

The index keeps the weekly consolidation alive around the 97.40/50 band.

If the buying pressure persists, the next target of relevance comes at the critical 200-day SMA near 97.70 ahead of the Fibo retracement of the 2017-2018 drop at 97.87.

The bullish outlook in DXY is expected to return as long as it trades above the 200-day SMA.

DXY daily chart