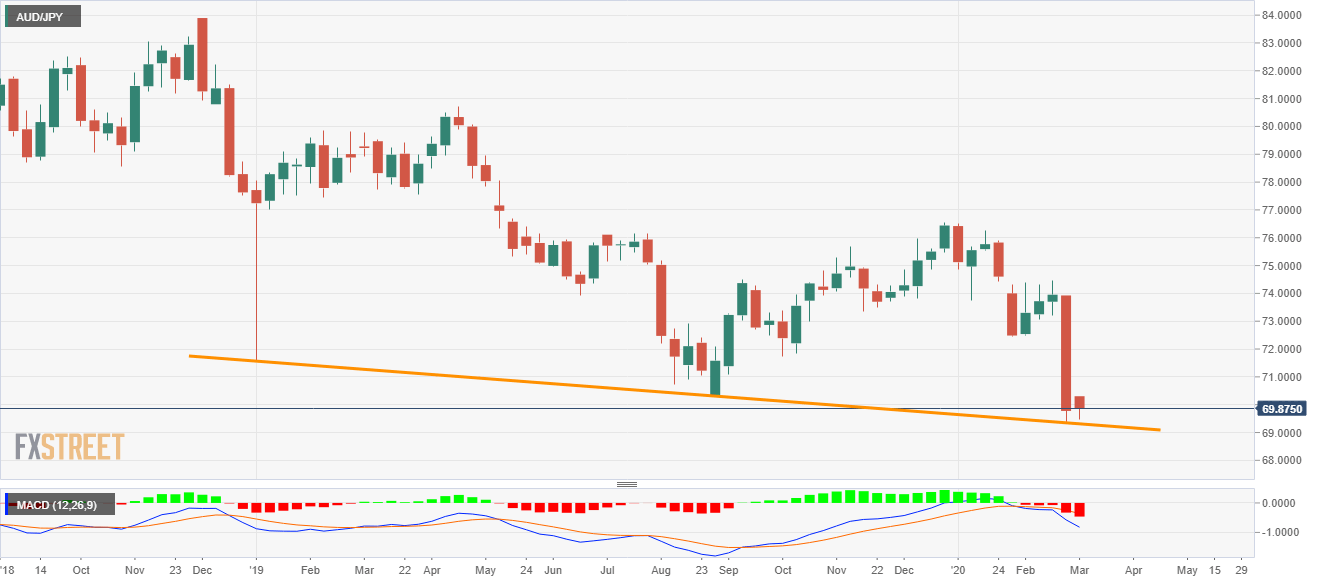

AUD/JPY Price Analysis: Sellers will look for entry below 69.30

- AUD/JPY awaits fresh clues to extend the previous week’s losses below the multi-year low.

- A descending trend line from early-January 2019 questions that bearish MACD.

- Buyers will hesitate to enter unless crossing January 2020 low.

Despite bouncing off the multi-week support line stretched from early 2019, AUD/JPY remains on the back foot while marking 69.8750 as a quote during the early Asian session on Monday.

That said, short-term buyers can aim for October 2019 low near 71.7350 during the pair’s recovery moves beyond 70.00 round-figure. However, late-January 2020 low around 72.45 could challenge the bulls afterward.

In a case where the buyers keep dominating past-72.45, 73.40 and the February month high surrounding 74.50 could return to the charts.

However, bearish MACD signals, as well as failures to register a strong upside momentum post-bounce from the key support line, continues to portray the pair’s weakness.

As a result, sellers will look for entry below the mentioned support line around 69.30. In doing so, early-January 2009 top near 68.20 and April 2009 bottom close to 66.80 will be on their radars.

AUD/JPY weekly chart

Trend: Pullback expected